Three pillars.

One team.

One vision.

Triasima Portfolio Management is a Canadian investment management firm serving institutional and high net worth clients based across Canada and the United States.

We are known for our Three-Pillar ApproachTM – hence the name Triasima – which integrates fundamental, quantitative, and trend analysis in a rigorous yet innovative process.

Our team is united around this unique investment management approach.

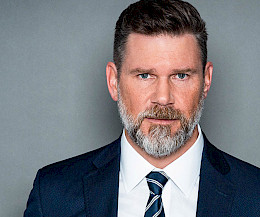

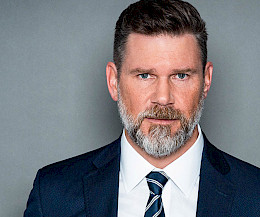

After a seven-year stint in corporate finance, André Chabot joined the portfolio management industry in the late 80s. Very early in his career, he started working on what would ultimately become the Three Pillar Approach™. Already at that time, faithful to his engineering background, André’s vision was to “add science and discipline to the art of portfolio management.”

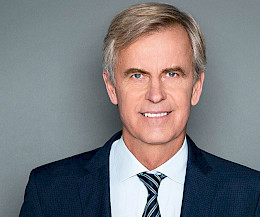

In 1998, while working for an investment management firm, André met Scott Collins. In 1999, they were joined by Redouane Khireddine. Already then, the Three-Pillar Approach™ was at the center of their portfolio management process.

In 2000, they spun off from their employer and incorporated Triasima. At the time, André, Scott and Redouane were the sole employees of the firm. They were involved on all aspects of its operations.

From very humble beginnings, Triasima experienced steady growth over time. It was then key –and it is still today– to build a scalable structure that would ensure the continued success of the firm’s clients. Above from having all the necessary systems in place, it was critical to develop a strong second and third generation of colleagues beyond André’s first and Scott and Redouane’s second generation status.

With the addition of key individuals like Mathieu Tanguay (President and Senior Partner), Nathalie Nowlan (Partner, Client Relationships), Estrela Rosoninha (Manager, Operations) and Nicolas Brodeur (Manager, Finance), the second generation is now well built-up. For the last few years, the focus has been on mentoring and expanding the third generation.

Today, with a high-quality team of 30 colleagues, welded around a sophisticated and proven Three-Pillar Approach™ and supported by leading-edge technology, the future looks more promising than ever!

Triasima is known for its Three-Pillar ApproachTM, an exclusive methodology that integrates fundamental, quantitative, and trend analysis in a rigorous yet innovative process that remains consistent in all market conditions.

This methodology allows us to deploy a robust investment process based on six core principles.

Our investment process is based on three analytical methods, our three "pillars": fundamental, quantitative, and trend. This means that all companies in which we invest are analyzed from three distinct and independent angles using well-defined criteria. Nothing is left to chance.

Our humble and disciplined approach allows us to avoid behavioural biases such as overconfidence and fear of regret, which often brings investors to make bad investment decisions.

The integration of environmental, social, and good governance criteria allows us to identify certain risks and opportunities linked to these factors, while contributing to the development of a better world.

Our portfolios are exposed to a wide range of styles, such as Growth, Value, and Momentum. This reduces risk by providing stability of returns for the portfolio through the various phases of the economic cycle.

In addition to building well-diversified portfolios, our team applies continuous risk management using state-of-the-art tools.

The Three-Pillar ApproachTM identifies not only attractive stocks, but also those that should be sold. We do not hesitate to replace a falling stock with a more promising one.

Triasima supports the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) as a foundational framework for reconciliation. We recognize the inherent rights of Indigenous Peoples, including the right to self-determination, land, culture, and self-governance.

As part of our commitment to responsible investment, we commit to engaging with companies on the respect of Free, Prior, and Informed Consent (FPIC) where Indigenous communities may be affected. We also consider violations of Indigenous rights to be a material ESG risk, with potential implications for long-term investment performance, social stability, and ethical accountability.

Respect

Humility

Integrity

Responsibility

Passion

Creativity

To be informed of our webinars and new communications